Ever wondered how to pay online in India as a foreigner? It’s a tricky task, but we’ve finally found a way. Read on and learn how to pay online in India as a foreigner with Airtel and PayTM.

Update 2019: Apparently the method below doesn’t work anymore. It is still possible to create the wallet with a fake passport number, but loading money doesn’t seem to work without KYC aproval. We’d love updates from readers who have tried the below method. An Indian passport number starts with a capital letter, followed by seven random numbers. Passport numbers never start or end with a zero. Thanks to all the readers who tried and let us know.

India is increasingly embracing online payment systems and mobile wallets. Bus and train tickets can be booked online, and even small paan shops now accept cards or digital money.

This is especially useful for travelers, as it allows you to buy train and bus tickets online, saving you the hassle of standing in line at the train station or paying extra fees to travel agencies.

Why yes, you can buy this with mobile payments.

It’s not easy to pay online in India as a foreigner

Unfortunately, due to India’s archaic laws and fear of foreign-sponsored terrorism, it’s not always easy to make online payments as a foreigner.

Not all vendors allow payments with a foreign debit or credit card, for instance, and the ones who do only work erratically (I’m looking at you, IRCTC). There are also plenty of charges associated with using foreign credit cards to pay online. These can quickly add up, especially on long trips.

Are mobile wallets the answer to making payments in India as a foreigner?

So how to pay online in India as a foreigner? Online wallets seem like a great alternative to paying with debit or credit card… right?

Here’s the problem: PayTM, the country’s biggest online wallet, doesn’t allow you to charge money with a foreign card. This means that PayTM doesn’t work for foreigners. The only way to load money on a PayTM wallet as a foreigner is to have an Indian friend transfer funds with his or her local debit or credit card.

(Talk about useless.)

Unless you have Indian friends whose card you can use, you’re stuck paying extra fees to either travel agencies or your online service provider when you want to buy tickets. Or worse, if you’re like me, you’ll end up shouting at your computer because IRCTC declined your payment for the sixth time for no apparent reason.

It only took us a million tries to buy these train tickets…

Airtel makes it easy to make payments in India as a foreigner

Luckily, it’s just become easier to make online payments in India as a foreigner. India’s largest mobile provider, Airtel, has just rolled out Airtel Payments Bank, a mobile wallet of sorts.

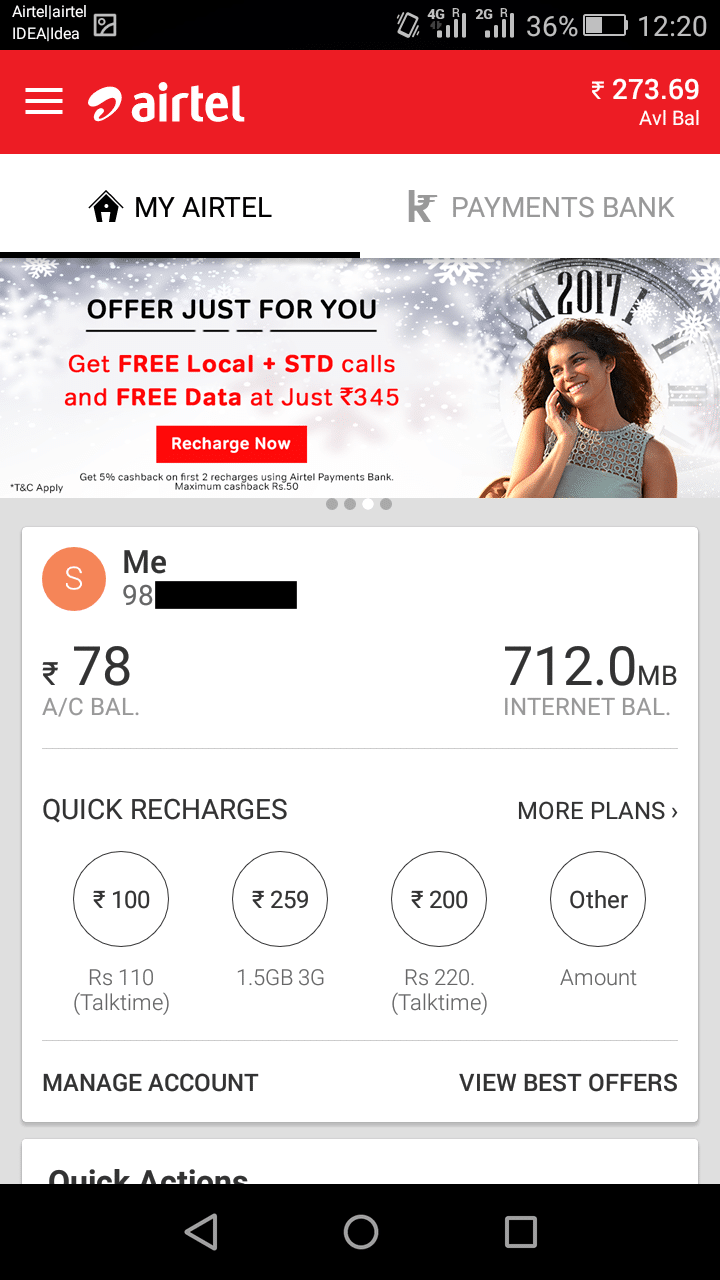

If you have an Airtel sim card—which we recommend, as it offers good coverage at decent rates—and download the My Airtel app (Android, iOS), you automatically have an Airtel Payments Bank account linked to your mobile number.

Tip: If you’re having trouble downloading the Airtel app, try using a VPN and setting your location to India to get it to download, or download the APK file.

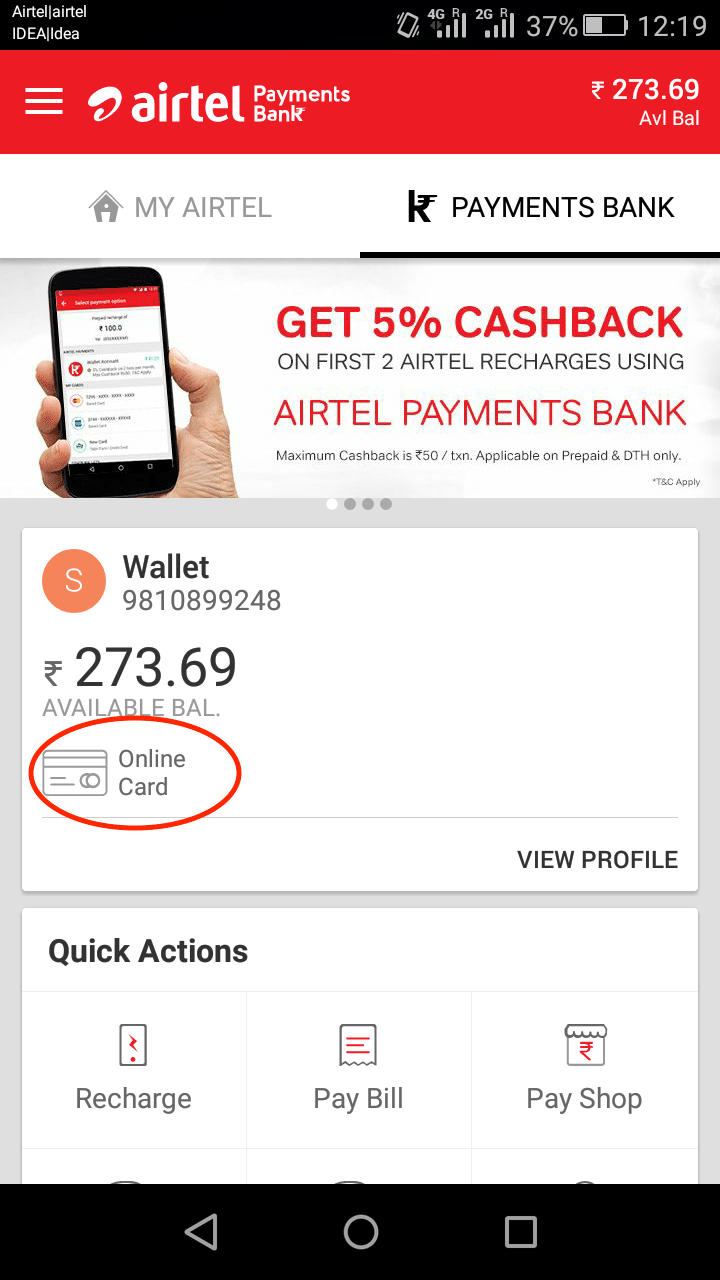

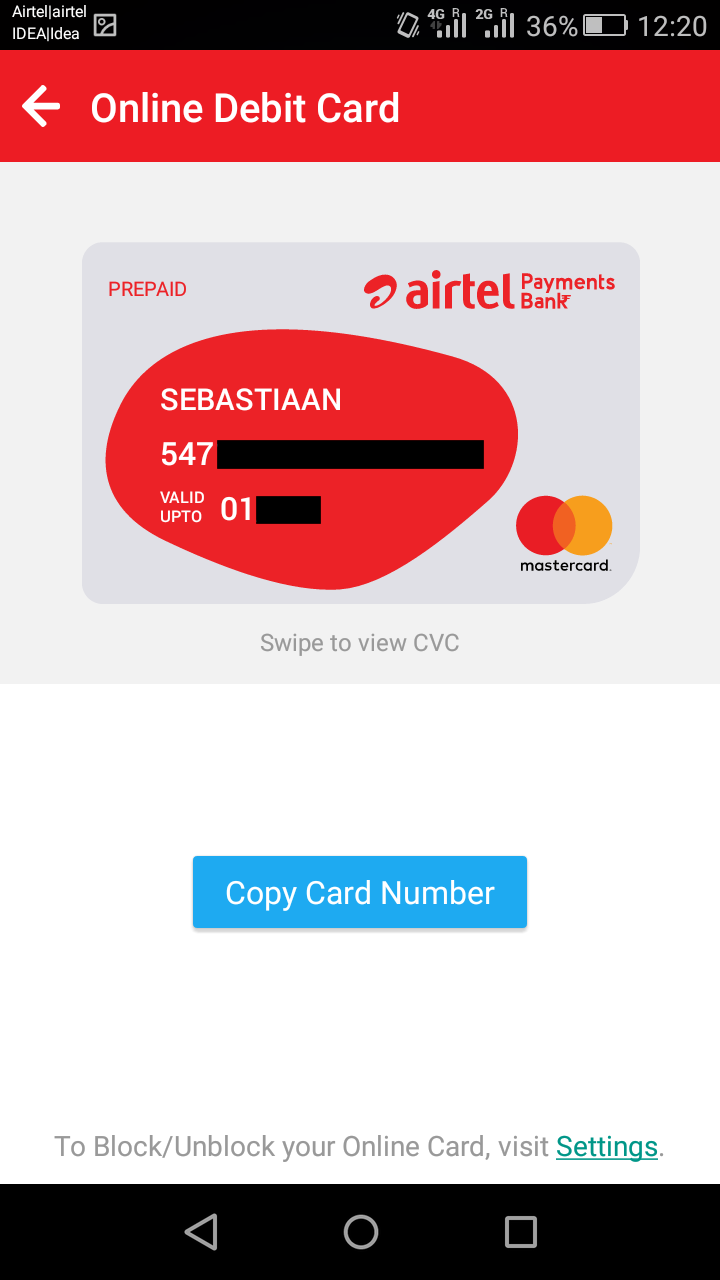

The great thing about the Airtel Payments Bank is that it basically gives you an online Indian debit card. The moment you deposit money in your Airtel Account, which can be done at a myriad of Airtel Stores throughout the country, you can start paying for things online using this debit card.

You can even use the card to top up PayTM, if you’d rather use the more popular mobile wallet. You can also use the money to top up your phone credit, or send credit to others regardless of carrier, which is pretty handy.

How to pay online in India as a foreigner with Airtel Money

- Get an Airtel sim card/phone number at any Airtel showroom. There’s also an Airtel stand right outside arrivals in the Delhi airport.

- Download the My Airtel app (Android, iOS). Use a VPN and set your location to India if you’re having problems finding it in the app store.

- Set up the My Airtel app.

- Register for the Airtel Money Payments Bank through the wallet icon in the top right corner of the My Airtel app. It should take less than a minute.

- Load Airtel money onto your sim card with cash. You can do this at any official Airtel store in India. Some have automatic payment machines, others you might have to convince the customer service rep to help you out.

- Use the debit card number from your Airtel Payments Bank for all your future online purchases, or to load money onto your PayTM account.

[bscolumns class=”one_third one_third_first”]

Disclaimer: Before you start worrying, we have not sold our soul to big corporate Airtel. Nor are we associated with them in any way. The sole purpose of this article is to make it easier for foreign travelers in India to pay for things online.

This is helpful to know, but still leaves me with a lot more fees and hassles than I have to deal with in the US. For instance, I can only withdraw 10,000 INR out of the bank at one time. Plus I have an ATM fee each time which is the same 200 INR for each withdraw. Small but adds up after 6 months, since I have to pay cash for EVERYTHING. Then I am loading it onto a wallet be it PayTM or AirTel now I am putting money back into a machine (IE means long line of people waiting to do this) and not to mention potentially filling out a form (IE, filling out an ICIC form to get money on my PayTM). Still means I am holding cash to get a digital payment option and still paying an ATM fee, just so I don’t have to carry twenty 100 INR notes all around so I can pay EXACT change all the time. I would like to hear if anyone has found a method to get everything done without waiting in a line, filling out a form or having cash limits.

Seems like it won’t work anymore because of a new rule called “kyc” or “know your customer” that requires you to have your physical documentation checked… this article was written last week: https://scroll.in/article/870873/indias-e-wallets-are-struggling-to-weather-the-storm-set-off-by-mandatory-aadhaar-linked-kyc-norms

Make some friends, it is easy in India, and if they have a Paytm account they transfer the amount onto your Paytm account and you give them the cash. No fees. You have to find a well off Indian with a Paytm account to be able to do that.

Down south like Kerala I don t get charged fees with the state bank of India. I repeat the transaction twice if I need rp20000. Not an issue.

The biggest problem these days is getting the sim card in the first place. Most places will want to see an adhaar card except, as i have heard, in an airport. Can anyone tell their experience of getting a simcardb as of 2018?

13/03/2018 i went to some brand stores with my international credit card but all of them pos machine declined it. Also I have tried to setup airtel wallet but needs indian documents to setup.

Goodbye india.

Slightly out of topic, but difficulty in using international credit card can also be found in the USA ! I recently visited usa and had difficulties using my international credit card for Metro North 10 offpeak ticket to Stamford pass or even the weekly NY subway pass. Apparently Metro North has a limit of some us$30 that can be used on a purchase ! So at Grand Central station ticket booth (not vending machine), I used my intl credit card for us$30 and cash for us$50 ! (Ps I don’t remember the exact amounts but they are in the right ballpark). The weekly NY subway pass cost approx us$35, and I could only buy one with my credit card on the machine ! It didn’t allow for a second one. I had another credit card, and again I could buy only one on it ! We were a party of 4, so two passes I had to buy with cash ! Not sure why such restrictions, especially in area of high intl tourists.

PS the staff explained the above restrictions were only on international credit cards, and due to fear of fraud ! Seemed ridiculous. In India (and indeed all countries that I have been to though never went to many african or central asian countries or china / north korea yet), I was able to use my international credit card everywhere. Though I didn’t use the smaller online websites. The only place I have been stumped is in NY subway / Metro North trains !

SIM card for foreigners can be obtained in India, but staff at some smaller outlets may not be aware. I recently got a vodafone prepaid sim. Bring along your passport and visa, and photocopies of them as the outlet i visited didn’t have a photocopy machine in it. Also a photo. You will need one set for each sim card you need. Not sure about how long the sim card remains activated. Some readers have commented 3 months. Not staying that long. The staff told me an outgoing call must be made every 30 days for it to remain activated.

I don’t carry much cash in India or elsewhere. Even small amounts can be paid by credit cards, including international credit cards. Cash is mostly used for autorickshaws. In india, eating in a restaurant can cost as low as us$2 and credit cards accepted ! For taxis in bigger cities, i am using uber. So all in, not much cash needed.

So the thing is, I added money to my wallet using my AMEX credit card, I was charged $1 for adding 1 rupees and same when I tried adding 5 rupees. So what exactly is the deal? How much will I be charged for adding 1000 rupees or more than that? What is the transaction fees? Please lemme know. Thank you,

Well, it looks like you can use an American Express Credit Card to load cash into your Paytm wallet. Just tried it with a US issued Amex..